5 Benefits of Engaging a Tax Consultant in Kenya

5 Benefits of Engaging a Tax Consultant in Kenya – As Benjamin Franklin said, “In this world, nothing can be said to be certain except death and tax”. A Tax is an involuntary financial charge levied on a taxpayer which in this pretext includes both an individual and a legal entity by a government body to finance government activities and various public expenses. A percentage of the taxpayer’s earnings are taken and remitted to the government.

Taxes are not always black and white. They can be complicated and dynamic and it can be hard to keep up with all the legislation being passed. One needs to have a comprehensive tax strategy that will help organize your finances, minimize your tax liability and reduce the stress that is brought about by filling the tax obligations.

Kenya’s taxation system has a wide variety of taxes which include Income tax, corporate tax, Pay As You Earn (PAYE), Withholding Tax, Value Added Tax among other types. The system is governed by an independent statutory body called the Kenya Revenue Authority which has different sections to govern the various types of taxes. It is also mandated to undertake individual and corporate tax reviews and assessments and this explains the recent news where the Kenya Revenue Authority is demanding Millions of Shillings from companies inform of unpaid taxes and penalties.

The need to hire a tax consultant is anchored solely on your business operations. A tax consultant can be a highly profitable investment and will help you avoid being slapped with penalties.

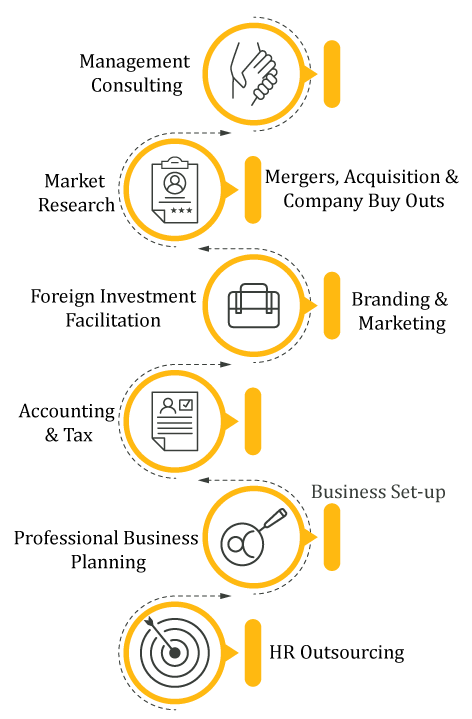

5 Benefits of Engaging a Tax Consultant in Kenya include the following;

We hope that you learnt something from this article on 5 Benefits of Engaging a Tax Consultant in Kenya. Contact us Today if you are looking for consultants to help you with your taxes in Kenya.