Branch vs Subsidiary Company Registration In Kenya

Branch vs Subsidiary Company Registration In Kenya

Branch vs Subsidiary Company Registration In Kenya – Which one is the Best for me? Many clients often ask us the above question and our answer to it is that “It all depends on the Business approach you want to take”. This is because in some instances, a Branch would be the most ideal entity while in other instances a Subsidiary would be the most ideal.

The major difference comes in when paying Taxes because a Branch Company will be taxed at 37.5 % Corporation Tax while a Subsidiary Company will be taxed at 30%.

However, having paid Tax at the higher rate, a Branch Company may remit after tax profits to its head office without any further deduction of tax whereas a subsidiary company must then deduct a further 10% on dividends paid to its parent.

See below a Comparison of a Branch vs Subsidiary Company Registration In Kenya

| Branch | Subsidiary | |

|---|---|---|

| legal Status | Not a separate legal entity but an extension of the Parent Company | Separate legal Entity distinct from its Parent Company |

| Liabilities | Liabilities Extend to Parent Company | Liabilities Limited to Subsidiary |

| Entity Name | Must be the same as the Parent Company | Can be the same or Different from Parent Company |

| Allowed Activities | Must be the same as the Parent Company | Can be the same or Different from Parent Company |

| Validity Period | Registered forever until closed | Registered forever until closed |

| Taxation | Taxed as non-resident entity, local tax benefits not available | Taxed as resident entity, local tax benefits available |

| Annual Filing | Must file Branch Office as well as Parent Company’s Accounts | Must file Accounts of the Kenyan Subsidiary |

| Bank Account | Can open Bank Account in Kenya | Can open Bank Account in Kenya |

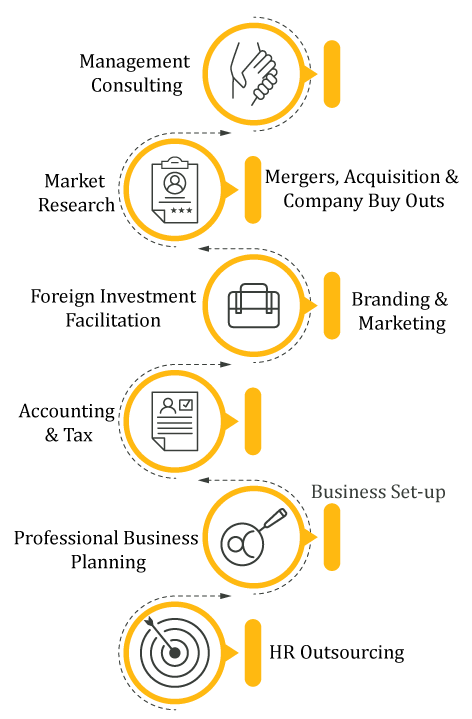

Click here to talk to one of our Business Set-up Expert for More Insight on Branch and Subsidiary Company Registration In Kenya and East Africa