Can a Foreigner Register a Company in Kenya?

Can a Foreigner Register a Company in Kenya? – Starting a company in Kenya has never been easier. The Hub of business in the Eastern African region welcomes investors more to take advantage of its growing economy, resident’s disposable income, and diverse talent.

In Kenya, business registration is overseen by the Registrar of Companies. This institution allows foreigners to start businesses in Kenya as either a:

- Subsidiary

- Branch

The registration requirements for these two options vary where a Branch requires you to have a local representative, while the same is not a requirement when registering a subsidiary. While there are many benefits of each option, I should mention that choosing to start your company as a subsidiary offers taxation benefits. When a company is registered as a Branch, it is regarded as a foreign entity and is subsequently required to pay 37.5% tax. On the other hand, a subsidiary is viewed as an independent organization and should only provide 30% tax to the Kenya Revenue Authority.

Now that we have answered your question on Whether a Foreigner can register a company in Kenya, below are some of the business forms you can register

Private Limited Company

Ownership Options

Foreigners are allowed to register the organization as the only 1 director and 1 shareholder. This means that you do not have to seek a local director to be part of your firm for successful registration.

Foreigners are also able to run this organization locally or from abroad. Through incorporating management consultants, the business can run even in your absence as you receive help in employee disbursements, filing tax obligations, and meeting other official requirements.

Minimum Investment Required

The Registrar of Companies does not stipulate the amount for investment for most of the unregulated industries in Kenya. Some industries like Insurance, Banking, Mining and Betting have some additional capital requirements often dictated by their regulatory body. The Minimum nominal share capital for unregulated industry is KES 100,000 (Approximately $1000). This is usually broken down to 1000 shares each with a value of KES 100 each.

However, if you intend to become a resident in Kenya then you will have to show proof of investing USD 100,000 in order to qualify for the Investors Class G work permit.

Limited Liability Partnership

One can also register a Limited Liability Partnership with:

- 2 corporate and individual partners

- A manager who must be allowed to work in Kenya (could be a citizen or foreigner with work permit)

This option is often appealing to many foreigners as all partners can enjoy the limited liability.

This options offers an advantage that partners are only required to pay individual income tax, rather than corporate tax imposed on Kenyan entities. All income gained on the business is taxed at the partnership level.

Public Limited Company

Foreigners looking to place their company under the Nairobi Stock Exchange (NSE) use this option as it facilitates public trading of shares.

While starting a private limited company is straightforward, more factors are considered when intending to launch a PLC. Individuals selecting this option must have be willing to give 30% of the company shares to local Kenyans. In addition, you require 7 shareholders and 3 directors before you commence operations.

Review the comparison of the companies below.

| Branch | Limited Liability Company (LLC) | Limited Liability Partnership (LLP) | Public Limited Company | |

| Wholly foreign ownership | Yes | Yes | Yes | Yes |

| Resident director required? | No | No | No | No

|

| Minimum directors required | 1 | 1 | 1 | 2 |

| Minimum shareholders/ Partners needed | 1 | 1 | 2 | 7 |

| Legal liability? | Yes | No | No | No |

| Resident company secretary required? | No | No | No | No |

| Kenya Corporate Tax? | 37.5% | 30% | 30% | 30% |

| Can sign contracts with local companies? | Yes | Yes | Yes | Yes |

| Can issues invoices? | Yes | Yes | Yes | Yes |

| Can import and export goods? | Yes | Yes | Yes | Yes |

Summary

The increased openness of the Kenyan economy has streamlined business registration for internationals looking to start a business in the country. You can register your firm in any of the aforementioned methods and start operating soon after.

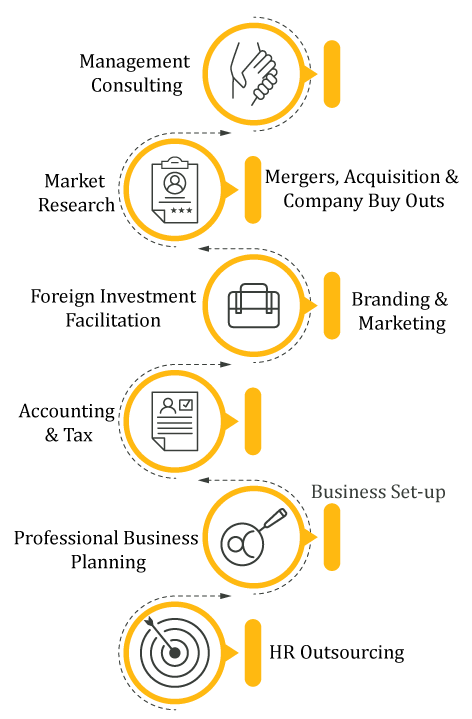

East Africa Business Consultants makes it much easier for you through conducting the whole registration process for you remotely. Furthermore, we also provide diverse solutions including HR recruitment, Marketing, Accounting and Tax, and General Business Consulting to help you succeed in the East African Market. Our combined years of experience and expertise in the registration process ensures we save you time and money. Therefore, you will be fully informed on the best approach to use when launching in Kenya and will be ready for operations before landing into the country!