How to Register a Non Deposit Taking Microfinance in Kenya

How to Register a Non Deposit Taking Microfinance in Kenya

You can either register your microfinance as a Non deposit taking microfinance or as a deposit taking microfinance otherwise known as a microfinance bank. There is a surge in the number of non deposit taking micro finance institutions setting up in Kenya due to the raise in demand for micro loans because commercial banks are now more keen to lend to the Government of Kenya because it is less risky and as a result neglecting the majority of the Kenyans at the bottom of the Pyramid.

The To Register a Non Deposit taking microfinace in Kenya takes about 1 month broken down to 2 weeks of seeking the letter of No Objection from the Central bank of Kenya and Another 2 weeks to finalist the registration process at the Registrar of companies.

The Requirements to register the Non Deposit Taking Microfiance in Kenya Includes the following;

- Three preferred names of the proposed company.

- Copies of the National identity card (For Kenyan nationals) and Copies of travel passport (for foreign investors)

- Passport size photographs

- Postal, physical and e-mail address, telephone number and occupation of all Shareholders/directors of the proposed company

- Share Apportionment percentage

- A Bank Statement with at least USD 100,000 in a foreign account (For Foreign Investors)

- A Business Plan/ a Company Profile

- Company email Address

- Target business start date

- Target accounting period end

- Number of employees at the business start date

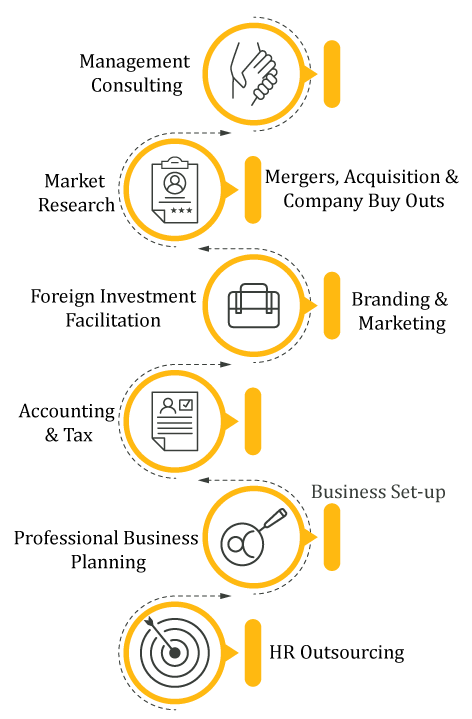

Kindly See Below an illustration on how to register a non deposit taking microfinance in Kenya

Click here to contact us for more details on how to register a non deposit taking microfinance in Kenya