Doing Business in Uganda

Doing Business in Uganda – Uganda is a land locked country that strategically shares borders with Kenya, Tanzania, Rwanda, the Democratic Republic of Congo and South Sudan. It has a population of approximately 37.6 billion people. The official languages are English and Swahili, although Luganda is widely spoken. According to Trading Economics, Uganda has a GDP of 27.48 USD. Also known as ‘The Pearl of Africa’, for its beauty and natural wonder, Uganda occupies a great part of Lake Victoria and boasts attractions like the Rwenzori Mountains, Murchison Falls and the famous Bwindi Impenetrable Forest.

The Government of Uganda strongly encourages private investment, both local and foreign. The country’ s strategic location gives it a commanding base to be a regional hub for trade and investment. Uganda has a highly liberalized and well–regulated economy in which all sectors are open for investment.

The 2019 Index of Economic Freedom ranked Uganda the 8th freest economy out of the 47 Sub-Saharan Africa countries, with a score of 59.7. The business operating environment allows the full repatriation of profits after all mandatory taxes have been paid. Uganda also allows 100% foreign ownership and the incentive regime is structurally embedded in the country’s tax laws making them non–discriminatory and accessible to both domestic and foreign investment depending on the sector and level of investment.

The main sectors encouraged for foreign investment are:

- Construction

- Commercial agriculture and Agro-processing

- Renewable and non-renewable energy

- Information Communication Technology (ICT)

- Tourism

- Packaging

- Pharmaceuticals

- Transport (Aviation)

- Infrastructure

The first step of doing business in Uganda is to legally register your business for official recognition. Registering a business in Uganda is fast and easy. You can either register your company as;

- A local company, meaning it has been incorporated and registered in Uganda or major shareholding is by Ugandans, and majority of the business is conducted in Uganda.

- A foreign company, meaning the company is fully owned by foreigners, but a branch of the same will be located in Uganda

The first step is to identify your preferred name and tun a name check to confirm its availability. Thereafter the name is reserved and the registration process begins. The requirements to register a company are as follows:

Local company:

- Full names

- Age and nationality

- Occupation of all shareholders/directors of the company

- Share apportionment percentage of all shareholders in the company.

The minimum number of directors/shareholders required in a company is Two.

Foreign company:

- Three certified and notarized copies of the company’s Certificate of Incorporation from the parent company.

- Three certified and notarized copies of the Memorandum and Articles of Association/Constitution of the parent company.

- Names and dates of birth of all the directors of the parent company

- Name of the company secretary

- Nationalities of all the directors

- Postal addresses of all the directors

- Business occupations of all the directors

- Share apportionment percentages of all shareholders of the company

- Name and postal address of a local resident in Uganda authorized to accept on behalf of the company, service of court process and any notices required to be served by the country.

- Full address of principle office in Uganda

For both local and foreign companies, additional Government approvals include tax registration. This is for any person doing business in Uganda. Upon application, the Uganda Revenue Authority issues a Tax Identification Number. This is the identifier in Uganda for business and tax purposes.

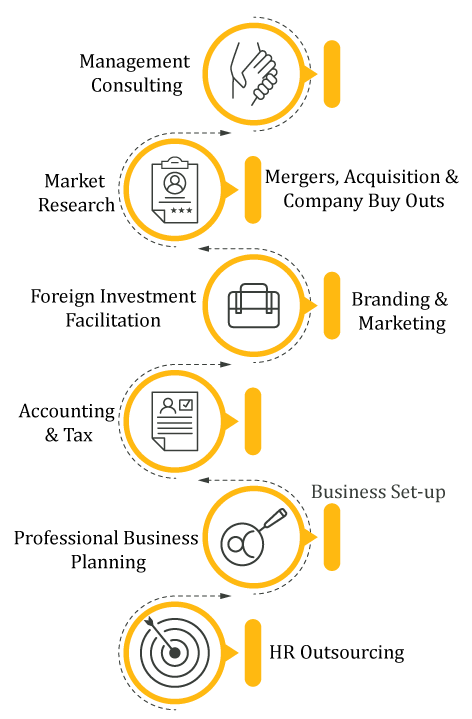

Doing business in Uganda is easy and profitable. Contact us today and we will get you started on your journey of investing in Uganda